Bitcoin Treasury Analytics

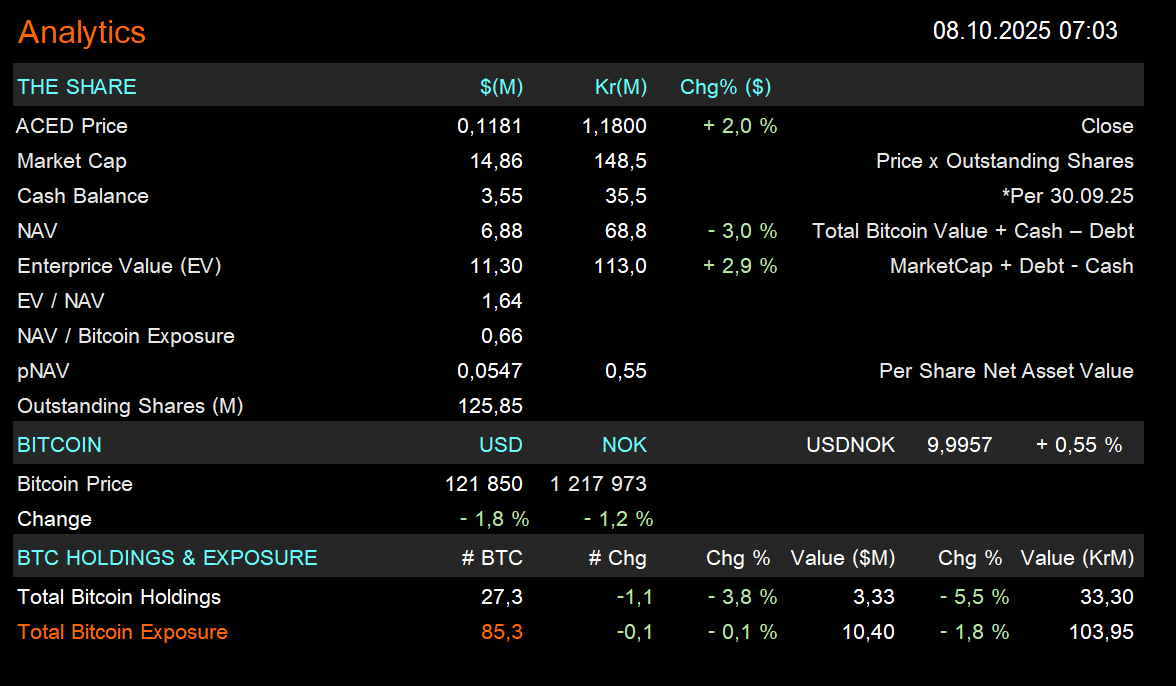

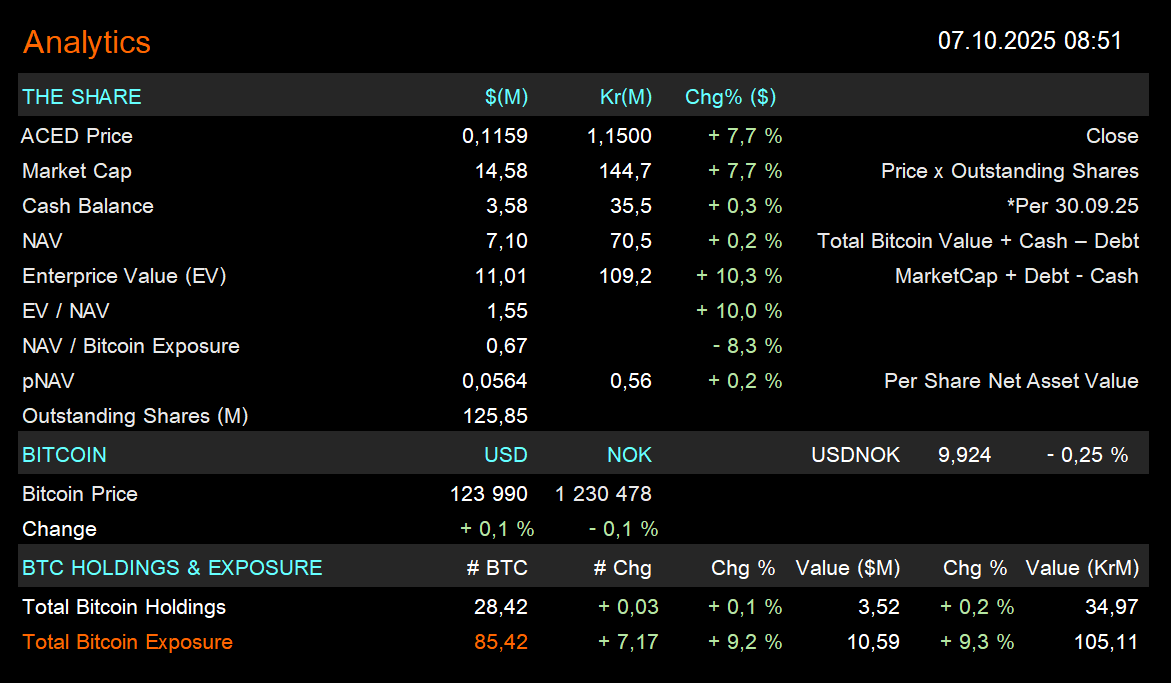

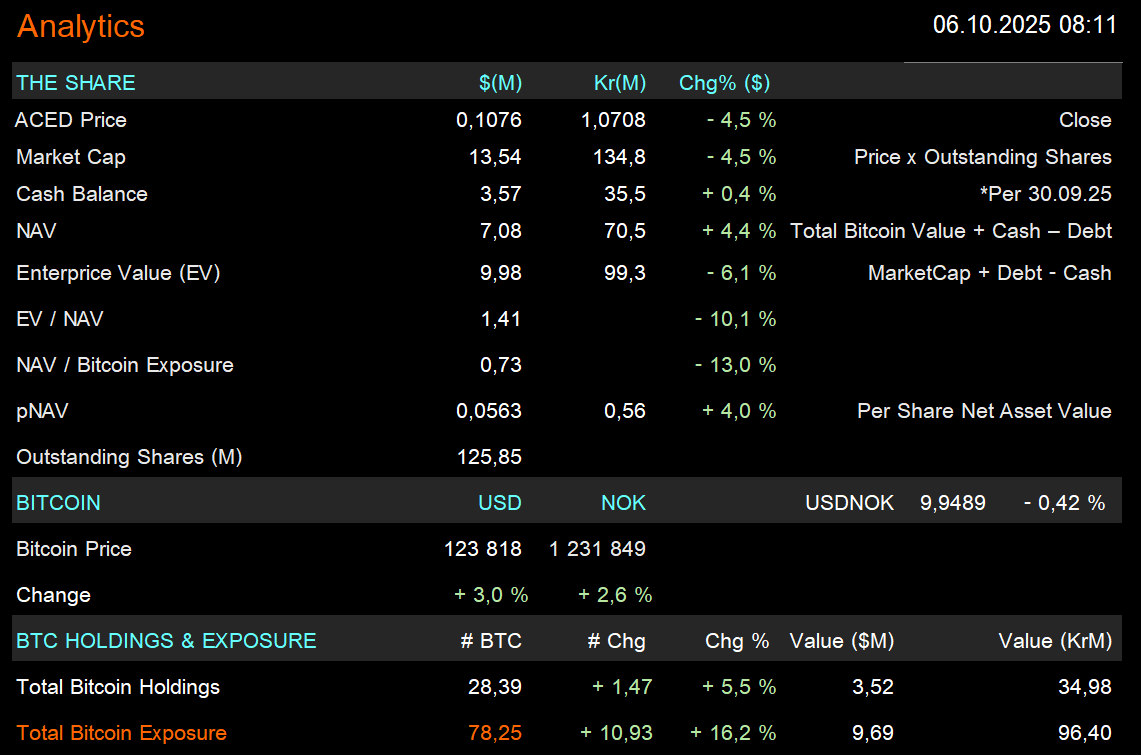

This section wil provide transparent and up-to-date insights into Ace Digital AS's Bitcoin treasury strategy. Our goal is to offer clear, data on key performance indicators (KPIs) that reflect our commitment to leveraging Bitcoin as a core treasury asset. This aligns with our mission to become the leading Nordic platform for Bitcoin-related opportunities. This page will be updated on a regulary outside Euronext Oslo Børs trading hours.

Notice: This dashboard is provided solely for informational purposes and is not intended as investment, financial, trading, or any other form of advice. The data displayed is sourced from publicly available information and should not be used as the basis for investment decisions. We recommend that investors consult our financial information page for the most current metrics.

Data Reliability: Although we aim to deliver accurate and timely information, we offer no guarantees, explicit or implied, regarding the completeness, accuracy, dependability, appropriateness, or availability of the data in this dashboard.

External Data: This dashboard may incorporate data from third-party sources. We do not verify or endorse the accuracy of such external information.

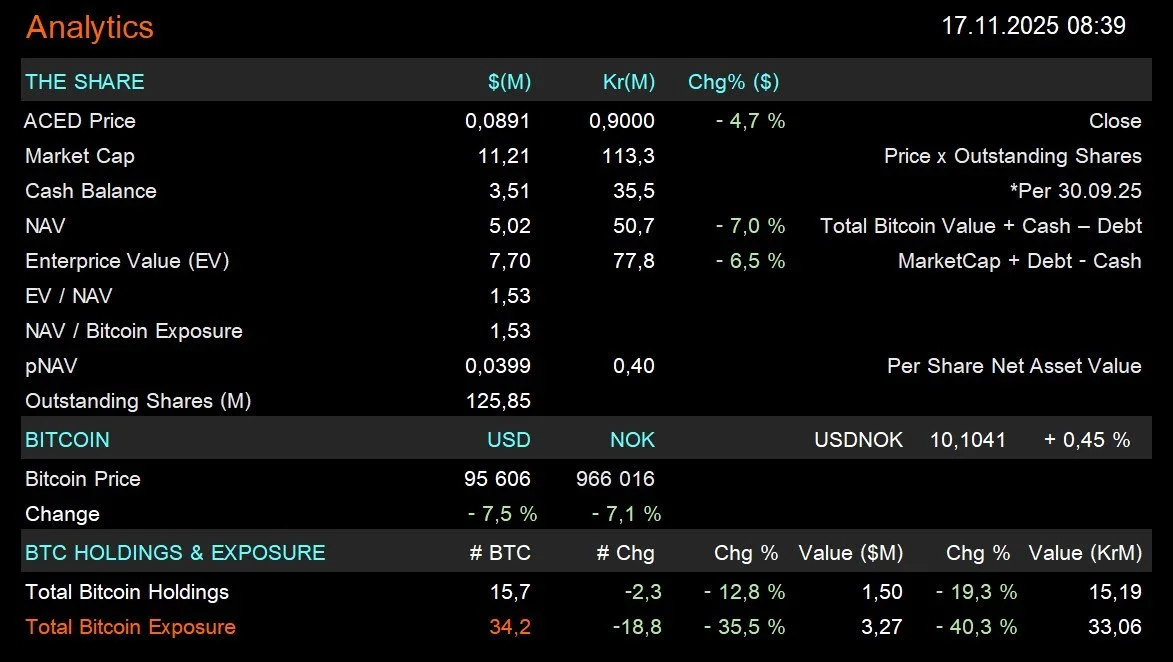

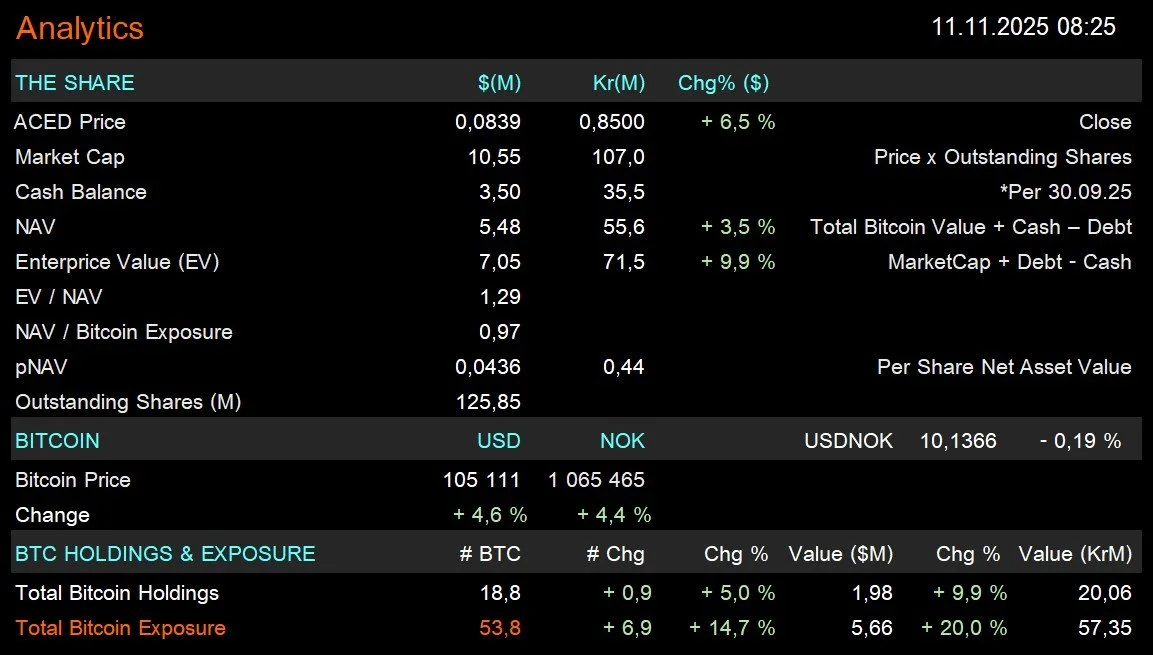

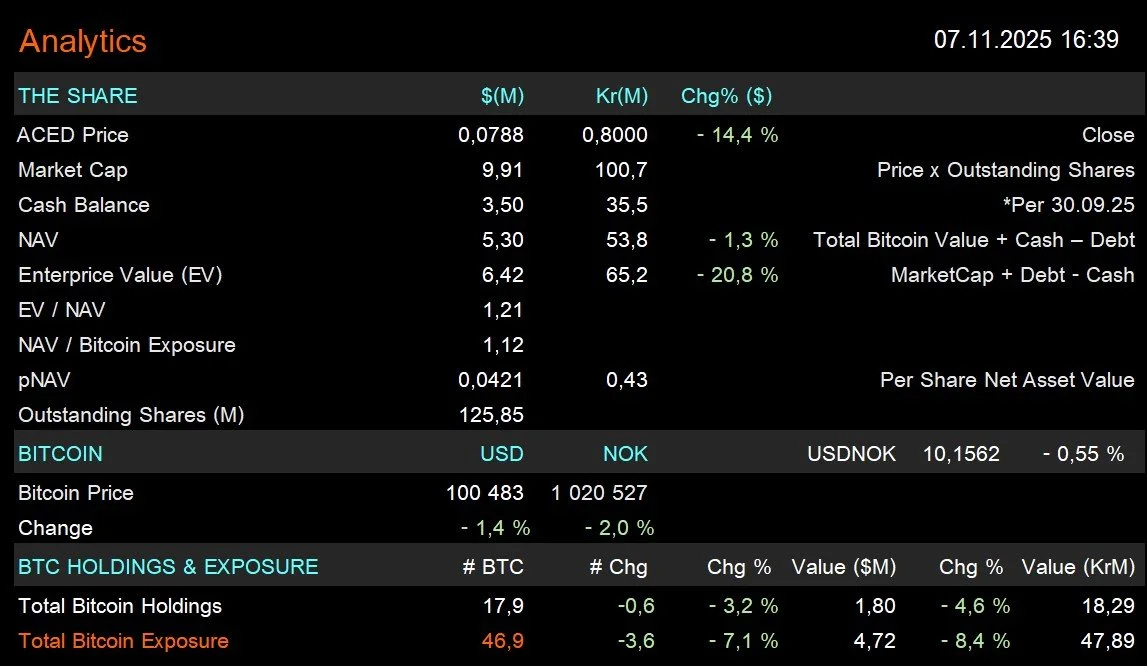

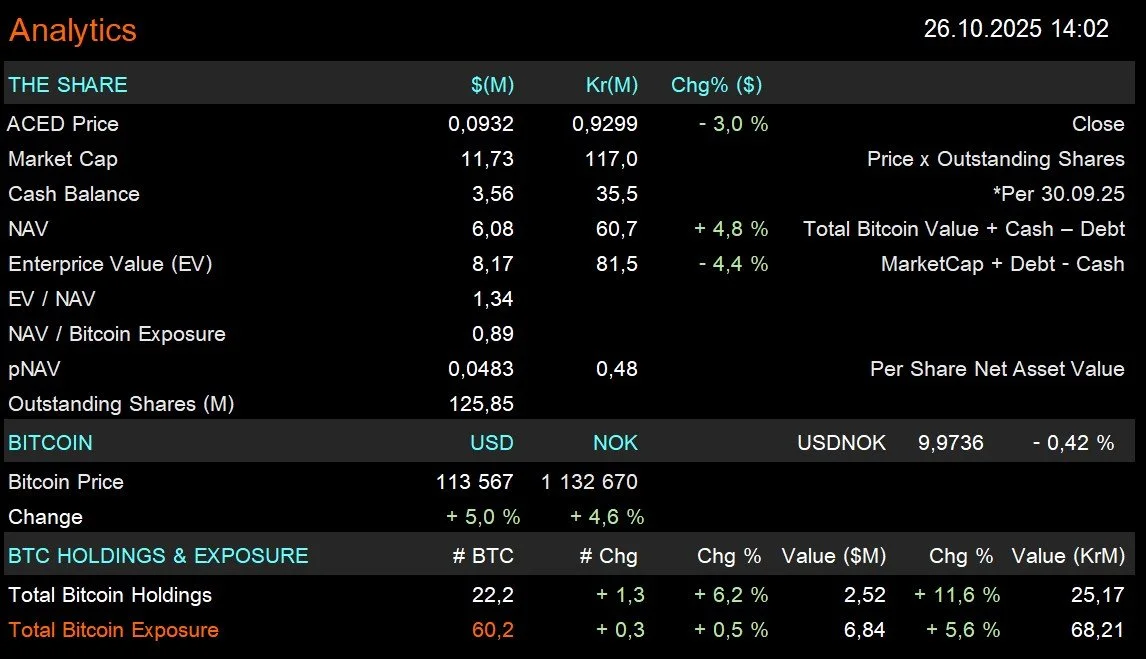

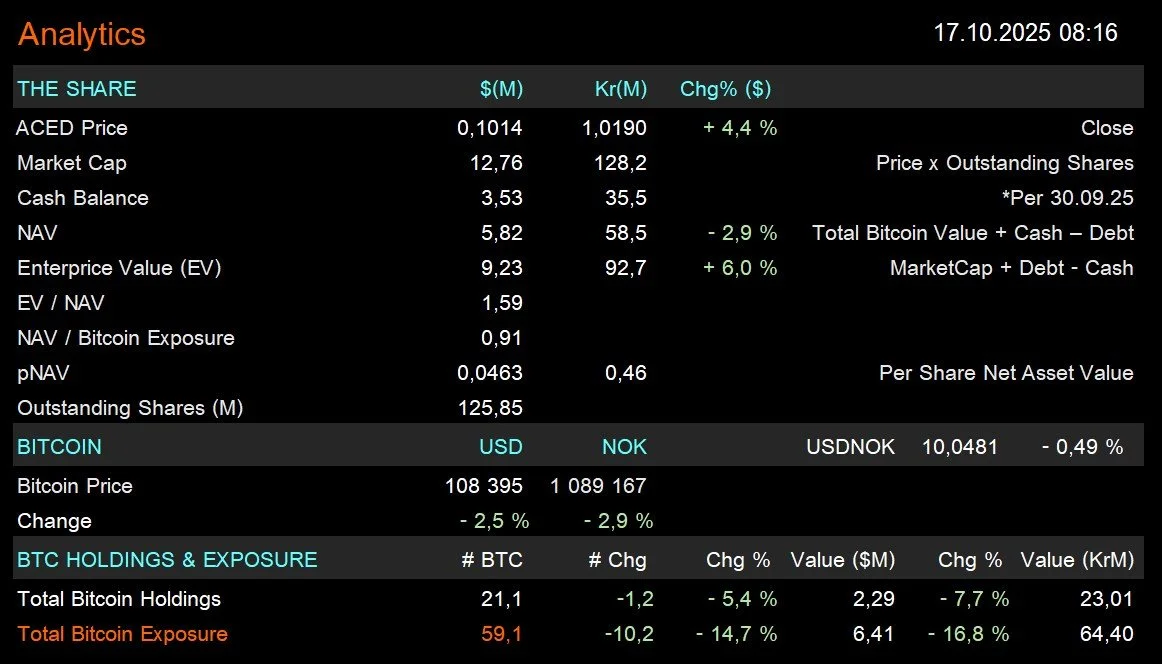

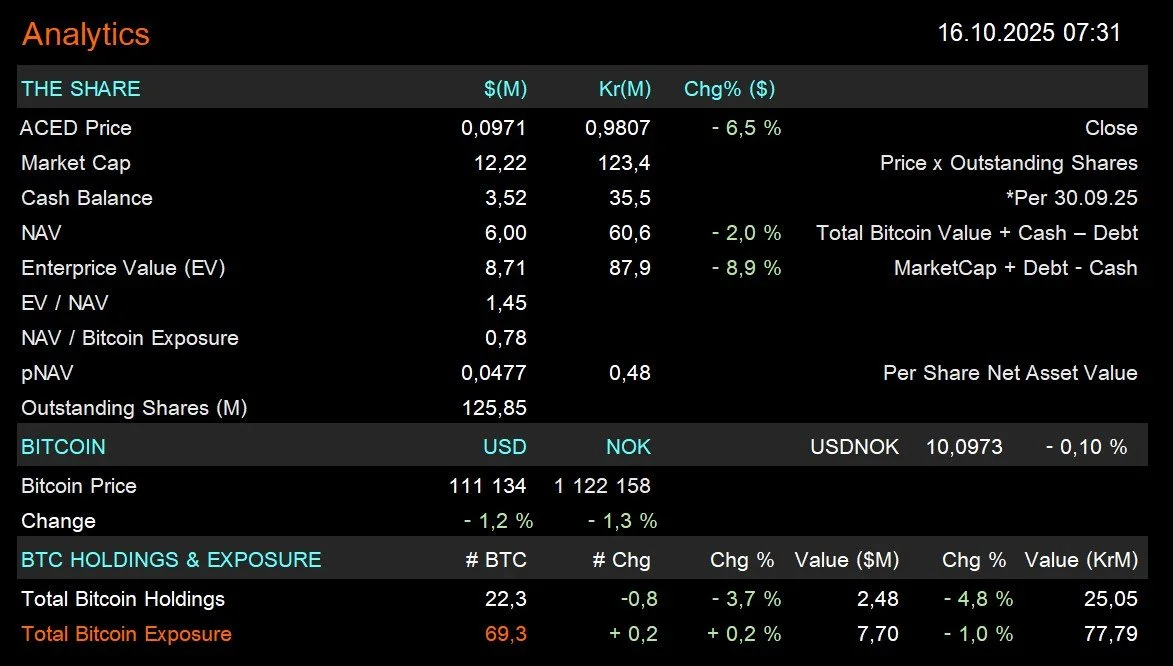

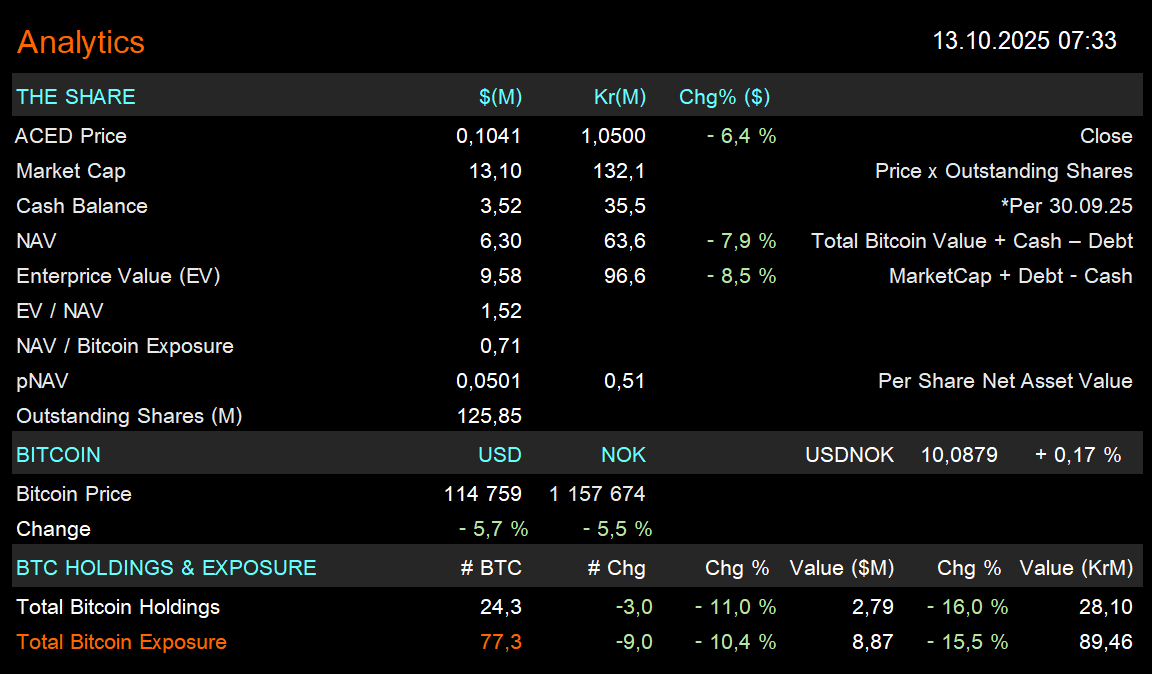

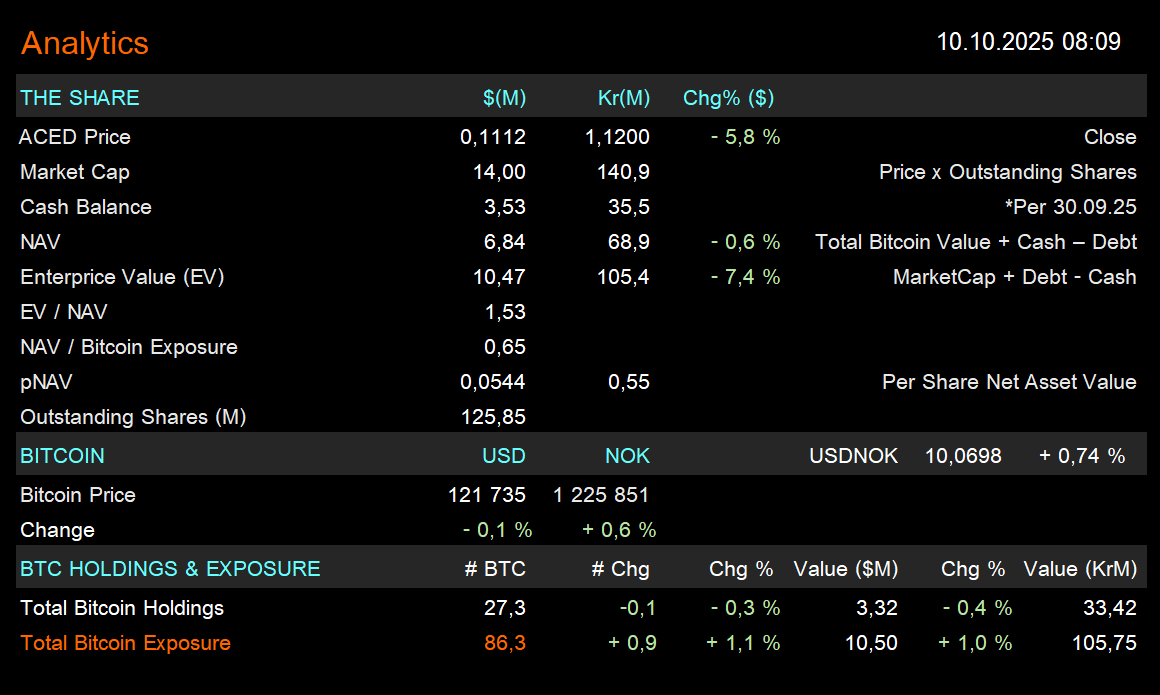

pNAV (Per-Share Net Asset Value): Calculation of net asset value per share, factoring in Bitcoin holdings and other assets/liabilities.

Bitcoin Holdings: Total amount of Bitcoin directly controlled by the Company.

Bitcoin Exposure: Comprehensive overview of the Company's total exposure to Bitcoin, including direct holdings as well as exposure through derivatives (e.g., futures, options, or other financial instruments).

Frequently Asked Questions (FAQ) About Our Option Strategies

Q: Note on the Data

A: The table provided is a snapshot and subject to change as market conditions evolve. Specific figures are not included here as they fluctuate continuously.

Q: What kind of option strategies do you use?

A: At Ace Digital, we primarily buy and sell call options to gain exposure to Bitcoin price movements, with a focus on purchasing more call options. We also trade put options to hedge and protect our Bitcoin holdings against potential downturns.

Q: Why do you sell some call options?

A: We sell certain call options to reduce the loss of time value and premium. As options approach their expiration date, their time value decreases, and selling helps us recover that value before it’s lost.

Q: What is your typical timeframe for these options?

A: Our main focus is on 3-6 month call options, which allow us to take a directional bet on Bitcoin’s price over a medium-term period. We also trade shorter-term options (by selling them) to offset the time value decay from our longer holdings.

Q: How does selling shorter-term options help?

A: By selling shorter-term options, we capture the time value before it diminishes, which helps balance the cost of holding our 3-6 month options. This approach minimizes premium losses while maintaining our overall strategy.

Q: Why not just buy more Bitcoin instead?

A: Buying call and put options gives us flexibility and protection. It allows us to benefit from Bitcoin price increases while using put options to safeguard our holdings. Our Bitcoin holdings fluctuate with the market direction due to the options strategy, but the risk is limited to a defined amount.

Q: How do you manage your cash reserves?

A: We maintain a substantial free cash position, enabling us to pursue other operational activities, advisory services, and venture investments within the Bitcoin ecosystem. We aim for a Bitcoin 1:1 exposure of funds received from share issuances, aligning our strategy with our capital.

Q: What do you do with your cash positions?

A: We allocate funds to high-interest bank accounts to earn interest and can use cash for carry trades. This helps us neutralize our operating expenses (OPEX), a key goal to ensure financial stability while supporting our investment strategy.

Q: Who is behind this strategy?

A: Our team at Ace Digital has over 30 years of experience trading options in traditional finance (TradFi) and approximately 5 years in Bitcoin. We implemented this strategy in 2022, and it has been proved effective.

Q: Can we expect the same results in the future?

A: While our strategy has been worked well in the past, there are no guarantees for future performance. Past success does not ensure future results, and we continuously adapt to market conditions.

If you have questions, feel free to ask! We’re here to explain our approach clearly.

Analogy Explaining Options

“Think of options like an effecient tool like an electric saw for a carpenter building a house—more efficient than a manual saw. But beware, know your tools; misuse of the electic saw, and you might more easily cut off a leg or two.”

James B. Bittman CBOE - 1994 presentation at Oslo Stock Exchange

With 30+ years of TradFi and 5 years of Bitcoin option experience, we handle this tool skillfully, limiting risk to our "Bitcoin at Risk" threshold. Still, no guarantees—past success isn’t future proof!