Ace Digital | Nordic Bitcoin Company

Based in Oslo, Norway, Ace Digital AS is a holding company dedicated to driving value in the Bitcoin ecosystem through strategic ownership and active management of subsidiaries and investments. Our mission is to become the most transparent and leading Nordic platform for Bitcoin-related opportunities, leveraging Bitcoin as a core treasury asset while delivering innovative products and services.

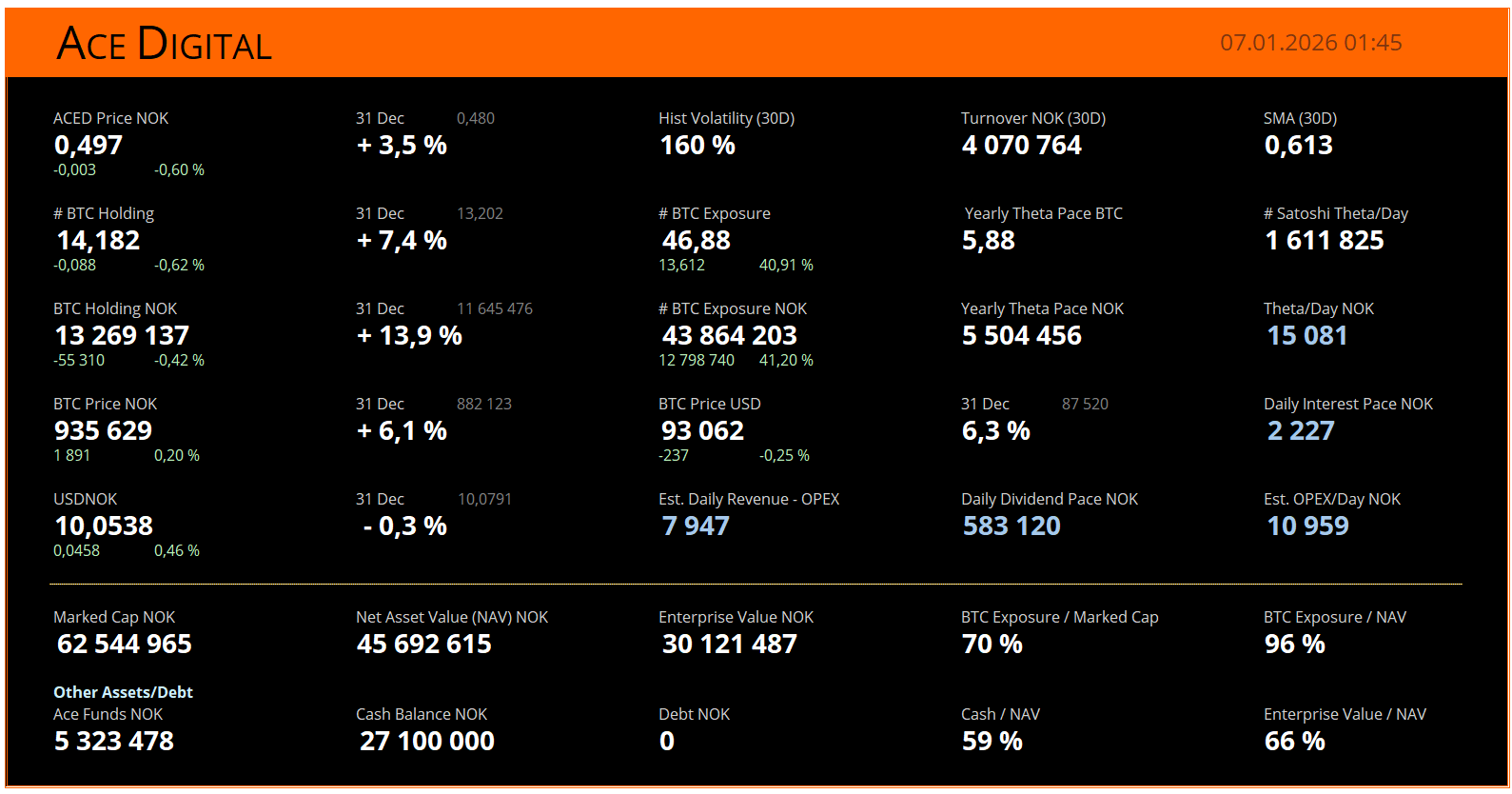

Ace Digital is listed on Euronext Growth Oslo with the ticker: ACED

Investment Disclaimer

Investing in Ace Digital (ACED) or any security involves significant risk, including the potential for substantial loss of principal. There is no assurance of profitability, liquidity, stable returns, or preservation of capital.The information and data presented in this dashboard are provided solely for informational and illustrative purposes. Nothing contained herein constitutes investment advice, a recommendation to buy, sell, hold, or otherwise transact in ACED shares, Bitcoin, or any other asset, security, or financial instrument, nor should it be interpreted as an endorsement of any investment strategy.

Historical performance, volatility figures, or any metrics shown do not predict or guarantee future results. The value of investments, including Bitcoin holdings, can fluctuate dramatically due to market conditions, regulatory changes, technological developments, or other factors. Past results are not indicative of future performance, and there is no representation that any investor will achieve similar outcomes or avoid significant losses.

This material is not intended as financial, tax, legal, or accounting advice. Individuals should conduct their own independent research and consult qualified professionals before making any investment decisions. Ace Digital and its affiliates disclaim any liability for losses arising from the use of this information.This disclaimer applies to all dashboard content and may be updated as needed. Always verify the latest version.

Glossary Here is an alphabetical list explaining the key terms from the Ace Digital (ACED) dashboard. The list is designed as a reusable appendix/attachment that can be used daily as the dashboard updates and values change.

# BTC Exposure Total Bitcoin exposure in BTC equivalents (direct holdings plus any indirect exposure through derivatives, funds, or other instruments).

# BTC Holding The actual number of Bitcoin directly owned by the company and held in its treasury.

# BTC Theta/Year Annual theta value (time-based value change, decay, or estimated effect) for the BTC exposure, expressed in BTC.

# Satoshi Theta/Day Daily theta value expressed in satoshis (1 BTC = 100 million satoshis). Represents the daily time-decay or value adjustment effect of the BTC exposure.

BTC Expo / Mrk Cap BTC exposure as a percentage of the company's market capitalization.

BTC Expo / NAV BTC exposure as a percentage of the company's Net Asset Value.

BTC Holding NOK Current market value of the company's direct BTC holdings, expressed in Norwegian kroner (NOK).

BTC Price NOK / BTC Price USD Current Bitcoin spot price in Norwegian kroner (NOK) and US dollars (USD).

Cash Balance NOK Company's estimated cash holdings in NOK 31.12.25 (excluding Bitcoin and other invested assets).

Debt NOK Total outstanding debt of the company, expressed in Norwegian kroner.

Enterprise Value NOK (EV) Enterprise value: market capitalization + total debt – cash and cash equivalents. Represents the theoretical cost to acquire the entire company.

EV / NAV Ratio of Enterprise Value to Net Asset Value (expressed as a percentage).

Hist Volatility (30D) Historical (realized) volatility of the share price calculated over the most recent 30 trading days, annualized and expressed as a percentage.

Marked Cap NOK Market capitalization: current share price multiplied by the total number of outstanding shares, in Norwegian kroner.

Net Asset Value NOK (NAV) Net asset value: total assets minus total liabilities (book value or liquidation value of the company), expressed in Norwegian kroner.

Other Assets/Debt Category covering all assets other than Bitcoin holdings (e.g. cash, funds, receivables) as well as any debt positions.

SMA (30D) 30-day Simple Moving Average: the arithmetic average of the share price over the most recent 30 trading days.

Theta/Year NOK & Theta/Day NOK Annual and daily theta value (time-based effect) converted from BTC terms to Norwegian kroner.

Turnover NOK (30D) Total trading volume (cumulative value of shares traded) in the stock over the most recent 30 days, expressed in Norwegian kroner.

USDNOK Current exchange rate between the US dollar and Norwegian krone.